Multiple Choice

Perch Corporation has made paint and paint brushes for the past ten years.Perch Corporation is owned equally by Arnold,an individual,and Acorn Corporation.Perch Corporation has $100,000 of accumulated and current E&P.Both Arnold and Acorn Corporation have a basis in their stock of $10,000.Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock.Due to the distribution,Arnold and Acorn Corporation must report:

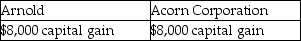

A)

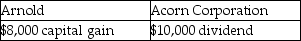

B)

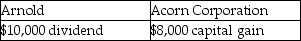

C)

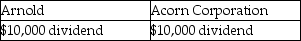

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q15: What must be reported to the IRS

Q16: When is E&P measured for purposes of

Q17: A shareholder's basis in property distributed as

Q18: Grant Corporation sells land (a noninventory item)with

Q27: Peter owns all 100 shares of Parker

Q52: Nichol Corporation has 100 shares of common

Q63: Which of the following statements is not

Q72: Blast Corporation manufactures purses and make-up kits.

Q80: Family Corporation, a corporation controlled by Buddy's

Q82: Identify which of the following statements is