Essay

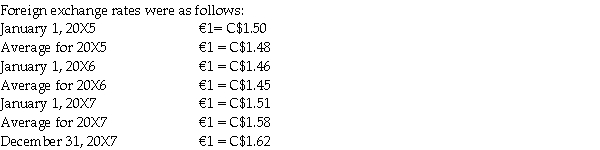

Water Bottling Inc.(WBI)is a 100% wholly owned subsidiary with operations in France.WBI was purchased by a Canadian parent on January 1,20X5.The financial records of WBI are maintained in euros and provide the following information with respect to equipment,intangibles and goodwill.

Equipment - purchased on January 1,20X5 for €250,000 - depreciated over 5 years on a straight-line basis.

Equipment - purchased on January 1,20X6 for €175,000 - depreciated over 5 years on a straight-line basis.

Required:

Assume that WBC's functional currency is the Canadian dollar.Calculate the translated Canadian dollar balances for the following accounts for December 31,20X7

a.Equipment

b.Accumulated depreciation - equipment

c.Depreciation expense

Correct Answer:

Verified

If the functional currency of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Under the temporal method, which of the

Q5: Liverpool Company operates retail stores in Canada

Q6: Cho Co. ,a public Canadian corporation has

Q6: For consolidation purposes, what exchange rate is

Q12: Under the temporal method, which of the

Q13: LaSalle Ltd. ,a Canadian company has a

Q19: For publicly accountable companies, with foreign operations

Q27: Which of the following is an indication

Q40: Which of the following statements about the

Q44: For private enterprises that use the current-rate