Multiple Choice

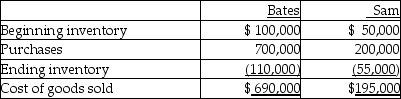

Bates Ltd.owns 60% of the outstanding common shares of Sam Ltd.During 20X6,sales from Sam to Bates were $200,000.Merchandise was priced to provide Sam with a gross margin of 20%.Bates' inventories contained $40,000 at December 31,20X5 and $15,000 at December 31,20X6 of merchandise purchased from Sam.Cost of goods sold for Bates and Sam for 20X6 on their separate-entity income statements were as follows:

What is the non-controlling interest's share of the consolidation adjustments on the income statement for the year ended December 31,20X6?

A) $2,000

B) $3,000

C) $5,000

D) $1,250

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Jordan Ltd. acquired 80% of Cool Co.

Q8: What is the purpose of showing an

Q23: Bates Ltd.owns 60% of the outstanding common

Q24: Bates Ltd.owns 60% of the outstanding common

Q26: On December 31,20X2,Bates Ltd.purchased 75% of the

Q29: Portia Ltd.acquired 80% of Siro Ltd.on December

Q30: Which consolidation method does not include incorporating

Q31: On December 31,20X5,Paper Co.purchased 60% of the

Q32: On December 31,20X2,the Esther Company purchased 80%

Q33: On December 31,20X6,the statements of financial position