Essay

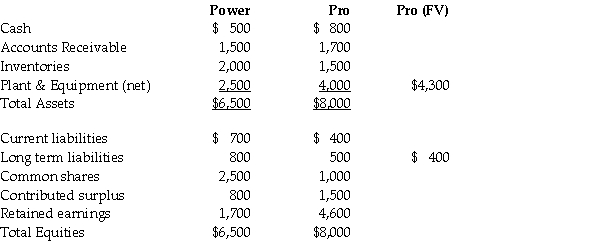

On December 31,20X6,the balance sheets of the Power Company and the Pro Company are as follows (amounts in thousands):

Power Company has 100,000 shares of common stock outstanding: Pro Company has 45,000 shares outstanding.All assets and liabilities have book value equal to fair values,except as noted.

The plant and equipment has an estimated remaining useful life of nine years from the date of acquisition.The long term liabilities mature on December 31,2010.Market value of the new shares issued was $90 per share at issuance.

Required:

Assume that 80% of the outstanding shares of Pro were acquired for cash of $5.8 million.Calculate goodwill and the non-controlling interest on the consolidated balance sheet at December 31,20X6 under the entity method and the parent-company extension method.

At December 31,20X9,the balance in the long term liabilities of Pro is still $500,000 and the balance of log term liabilities for Power is $900,000.Calculate the balance in the consolidated Long-term liabilities balance as at December 21,20X9.

Correct Answer:

Verified

Entity method and the Parent company ext...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Jordan Ltd. acquired 80% of Cool Co.

Q15: Sunny Co. purchased 80% of Reuben Ltd.

Q16: On December 31,20X2,the Esther Company purchased 80%

Q17: On December 31,20X5,Paper Co.purchased 60% of the

Q19: Under the parent-company extension method,to which company

Q21: On September 1,20X5,High Limited decided to buy

Q22: Which consolidation method includes only the parent's

Q23: Bates Ltd.owns 60% of the outstanding common

Q24: Bates Ltd.owns 60% of the outstanding common

Q27: Olthius Ltd. purchased 60% of Fredo Ltd.