Multiple Choice

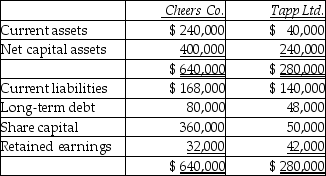

Cheers acquired 100% of Tapp's shares for $150,000.On the acquisition date,the fair value of the current assets and the net capital assets were $104,000 and $216,000 respectively.The fair value of the liabilities equalled their book value.What is the amount of goodwill created in this acquisition?

A) $(24,000)

B) $ 0

C) $18,000

D) $40,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: At December 31, 20X0, Crowe Company has

Q12: Dupuis Ltd.acquired Waul Ltd.through a business combination

Q13: Slade Co.has 1,000,000 shares outstanding and is

Q14: Raj Co.acquired all of Event Ltd.'s common

Q16: On December 31,20X5,CI Co.purchased 100% of the

Q17: Sugar Corp and Syrup Limited have reached

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1557/.jpg" alt=" Cheers acquired 100%

Q20: Nashman Ltd.is a private enterprise with five

Q23: Able Ltd. offers to buy shares from

Q32: How should accounting fees for an acquisition