Essay

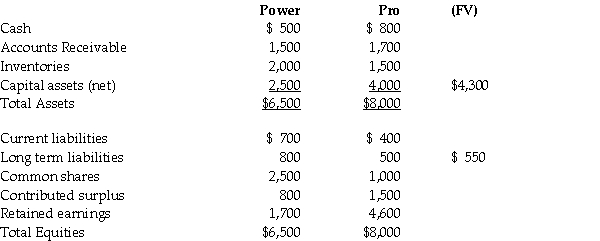

On December 31,20X6,the statements of financial position of the Power Company and the Pro Company are as follows: (in 000s)

Power Company has 100,000 shares of common stock outstanding.Pro Company has 45,000 shares outstanding.On January 1,20X7 Power issued an additional 90,000 shares of common stock in exchange for all the net assets of Pro.All assets and liabilities have book value equal to fair values,except as noted.In addition,Pro has a patent that has an appraised fair value of $450.

Market value of the new shares issued was $95 per share at the date of acquisition.

Required:

a.What is the amount of goodwill to be recorded for this business combination? Prepare the journal entry that Power would record on January 1,20X7 related to this acquisition.In this case,who are the shareholders and their percentage holdings on January 1,20X7? Prepare the statement of financial position for Power as at January 1,20X7.

b.How would your answer differ if Power had purchased the shares rather than the net assets of Pro Company? In this case,who are the shareholders and their percentage holdings on January 1,20X7?

Correct Answer:

Verified

Part a

Calculation of goodwill (in 000s)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Calculation of goodwill (in 000s)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Which of the following is not a

Q4: How should the cost of issuing debt

Q20: Nashman Ltd.is a private enterprise with five

Q21: Push-down accounting requires _.<br>A)fair value adjustments to

Q27: On January 1,20X7,Falcon acquired the net assets

Q31: Sya Ltd. acquired all the assets and

Q34: What is the most common valuation method

Q38: Sya Ltd. acquired all the assets and

Q41: How should negative goodwill be shown on

Q42: After an exchange of shares in a