Essay

On September 1,20X7,Spike Limited decided to buy 100% of the outstanding shares of Volley Inc.for $1,200,000 paid for with the issuance of shares.In addition Spike has agreed to pay an additional $250,000 if the revenues of Volley have a 5% growth over the next two years from the date of the acquisition.It has been determined that the fair value of this contingent consideration is $175,000.

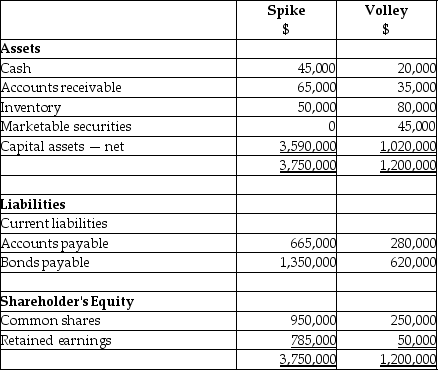

The balances showing on the statement of financial position for the two companies at August 31,20X7 are as follows:

After a review of the financial assets and liabilities,Spike determines that some of the assets of Volley have fair values different from their carrying values.These items are listed below:

Capital assets - fair value is $1,350,000

Patent - fair value is $255,000

Brand name - fair value is $135,000

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1,20X7.

Correct Answer:

Verified

Calculation of goodwill:

Fair ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Fair ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Which of the following is not a

Q3: Which of the following statements about a

Q5: On March 17,20X2,Cho Co.acquired 100% of the

Q6: Perez Co. acquired Roo Co. in a

Q10: There are a number of possible approaches

Q23: Able Ltd. offers to buy shares from

Q25: Under IFRS 3, Business Combinations, which method

Q27: Perez Co. acquired Roo Co. in a

Q32: How should accounting fees for an acquisition

Q40: Sya Ltd. acquired all the assets and