Multiple Choice

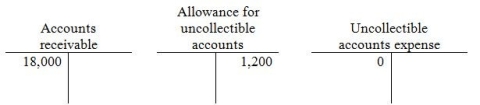

At January 1,Everbright Sales has the following balances:  During the year,Everbright has $150,000 of credit sales,collections of $140,000,and write-offs of $3,000.Everbright records Uncollectible accounts expense at the end of the year using the aging method.At the end of the year,the aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts at end of year.

During the year,Everbright has $150,000 of credit sales,collections of $140,000,and write-offs of $3,000.Everbright records Uncollectible accounts expense at the end of the year using the aging method.At the end of the year,the aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts at end of year.

- After the year-end entry to adjust the Uncollectible accounts expense is made,what is the final balance in the Allowance for uncollectible accounts?

A) Debit of $1,800

B) Credit of $4,200

C) Credit of $1,900

D) Debit of $3,000

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Which of the following is included in

Q116: The following information is from the

Q118: The Allowance for uncollectible accounts currently has

Q119: The income statement approach computes uncollectible accounts

Q120: Which of the following is TRUE of

Q122: On December 1,2014,Parsons Sales sold machinery to

Q123: The acid-test ratio is computed as current

Q124: A business is holding a note receivable

Q125: The two major types of receivables are

Q126: Which of the following is a disadvantage