Multiple Choice

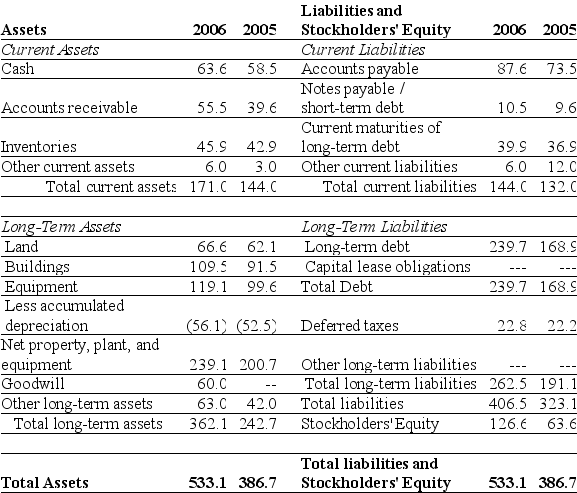

Use the table for the question(s) below.

-Refer to the balance sheet above.If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

A) 0.39

B) 0.76

C) 1.29

D) 2.57

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use the table for the question(s) below.<br>AOS

Q12: Which ratio would you use to measure

Q45: What is the role of an auditor

Q89: The management of public companies are not

Q101: Use the table for the question(s)below.<br> <img

Q104: Use the table for the question(s)below.<br> <img

Q105: Use the table for the question(s)below.<br> <img

Q107: Use the table for the question(s)below.<br>AOS Industries

Q109: Accounts payable is a<br>A)Long-Term Liability.<br>B)Current Asset.<br>C)Long-Term Asset.<br>D)Current

Q111: Company A has current assets of $42