Essay

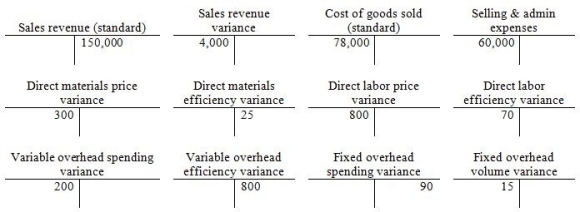

Atlas Manufacturing is closing the year 2012. Atlas uses standard costing methodology in its accounting system and for internal performance reporting. Atlas's ending balances are shown here:

Using the format below, please prepare a statement of operating income.

Correct Answer:

Verified

\[\begin{array} { | l | l | l | l | }

\...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

\...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Which of the following is an example

Q45: The Carolina Products Company has just completed

Q46: Faas Marine Stores Company manufactures decorative

Q47: Atlantic Manufacturing Company uses standard costing

Q48: Ibis Company prepared the following static

Q50: Which of the following statements is TRUE

Q51: Zennick Fashion Products uses standard costs

Q52: For companies using standard costing accounting procedures,

Q53: A quantity variance measures how well a

Q54: When management is investigating overhead variances, they