Essay

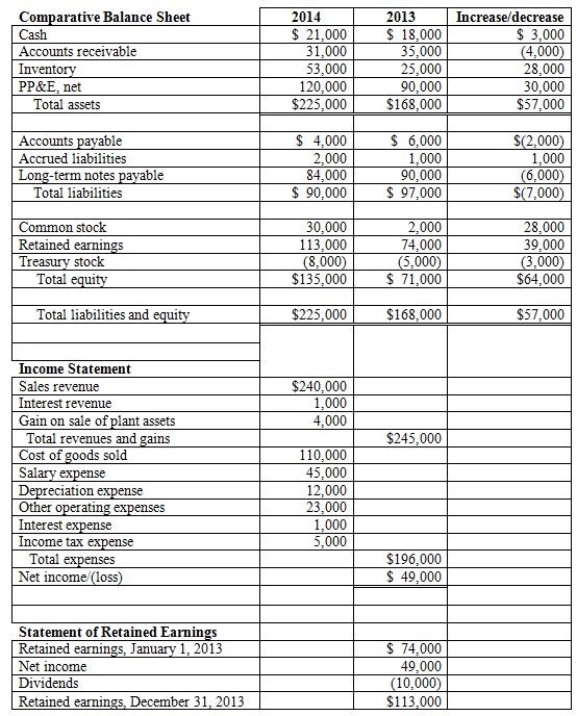

Avatar Company uses the direct method to prepare its statement of cash flows. Please refer to the following financial statement information for the year 2014:

Additional information provided:

• Equipment costing $52,000 was purchased for cash.

• Equipment with a net asset value of $10,000 was sold for $14,000

• Depreciation expense of $12,000 was recorded during the year.

• During 2014, the company repaid $40,000 of long-term notes payable.

• During 2014, the company borrowed $34,000 on a new note payable

• There were no stock retirements during the year.

• There were no sales of treasury stock during the year.

Please prepare a complete statement of cash flows using the direct method, in the following format:

Correct Answer:

Verified

Correct Answer:

Verified

Q145: Which of the following items would be

Q146: Parmesan Company uses the direct method

Q147: Investing activities include activities that affect the

Q148: Qtopia Company uses the direct method to

Q151: Avatar Company uses the indirect method to

Q152: In creating a statement of cash flows

Q153: Avatar Company uses the indirect method

Q154: A statement of cash flows is generated

Q155: In creating a statement of cash flows

Q159: Investors and management use the statement of