Multiple Choice

Pettijohn Inc.

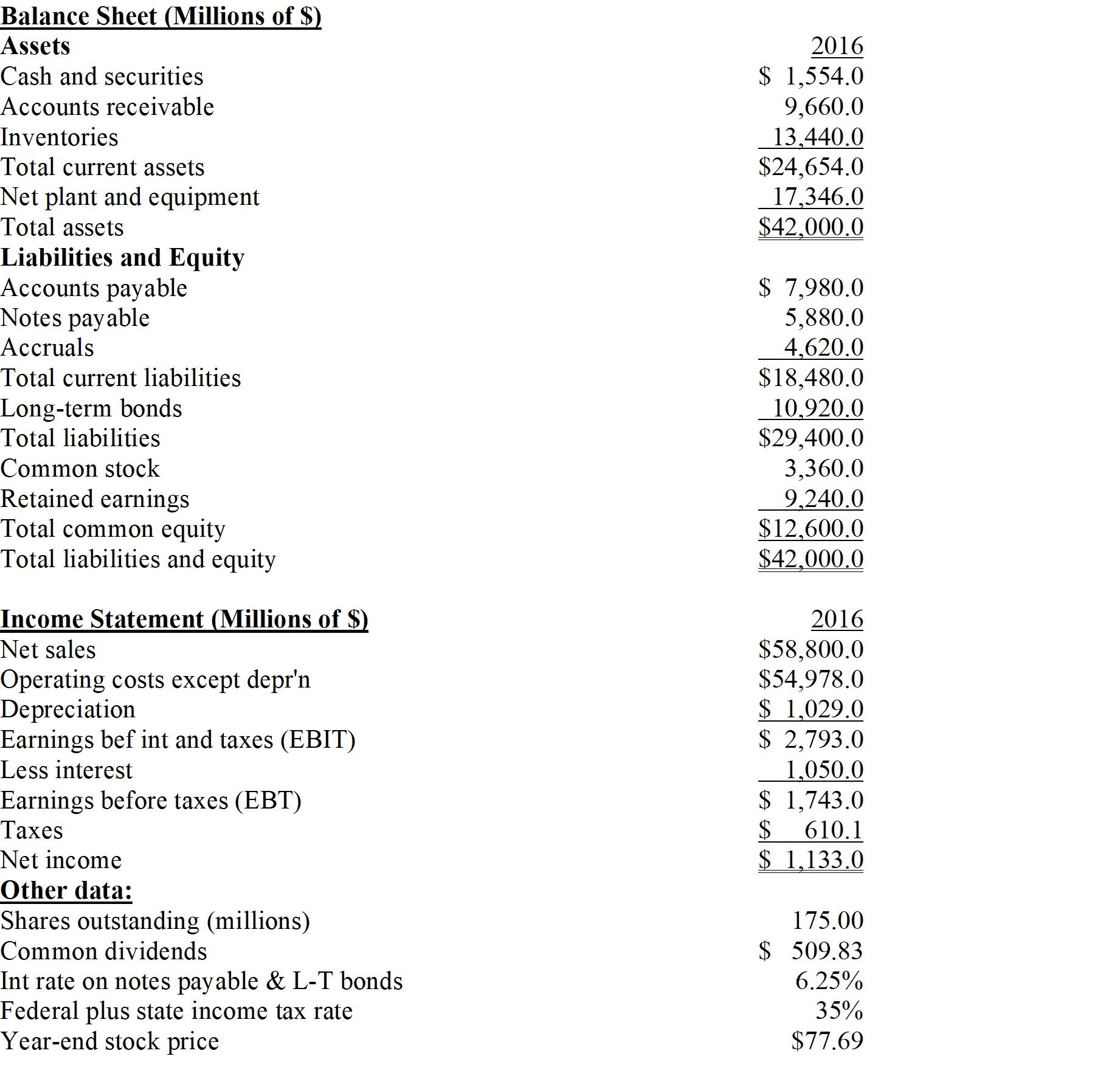

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's cash flow per share?

A) $10.06

B) $10.59

C) $11.15

D) $11.74

E) $12.35

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Vang Corp.'s stock price at the end

Q22: Significant variations in accounting methods among firms

Q26: The basic earning power ratio (BEP) reflects

Q45: Companies Heidee and Leaudy are virtually identical

Q45: Rappaport Corp.'s sales last year were $320,000,

Q51: You observe that a firm's ROE is

Q55: pettijohn Inc.<br>The balance sheet and income

Q55: A firm wants to strengthen its financial

Q76: pettijohn Inc.<br>The balance sheet and income

Q93: Suppose Firms A and B have the