Multiple Choice

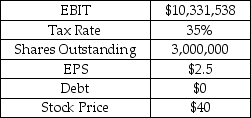

You are a buy-side analyst researching the Gorilla Glass Co.Gorilla plans to borrow $11 million by issuing bonds with an annual coupon of 7% and a yield to maturity of 7%.Gorilla will use the borrowed money to repurchase shares on the open market at $40 per share.You have gathered the information,shown in the table,regarding the company prior to the repurchase.You estimate that EBIT for Year 1 will be the same as reported for Year 0.Assume that the money is borrowed and the repurchase is executed at the beginning of Year 1.

Gorilla Glass Co.

Dec 31,Year 0

What is the Year 1 EPS?

A) $2.00

B) $2.28

C) $2.80

D) $3.25

E) $3.52

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Smith Motors Inc.manufactures,distributes,and services automotive parts and

Q23: Smith Motors Inc.manufactures,distributes,and services automotive parts and

Q24: Smith Motors Inc.manufactures,distributes,and services automotive parts and

Q25: Shares of Brockshire Holding Company Inc.trade for

Q26: Sweetums Inc.,a confectioner best known for its

Q28: Wayne Enterprises Inc.has a target debt/equity ratio

Q29: Select financial data for Ewing Oil Inc.is

Q30: B&O Railroad Inc.transports industrial products and supplies

Q31: On January 1,Year 1 you bought 100

Q32: Climax Motors Corp.is an all equity company