Essay

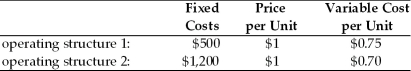

China America Manufacturing is evaluating two different operating structures which are described below.The firm has annual interest expense of $250,common shares outstanding of 1,000,and a tax rate of 40 percent.  (a)For each operating structure,calculate

(a)For each operating structure,calculate

(a1)EBIT and EPS at 10,000,20,000,and 30,000 units.

(a2)the degree of operating leverage (DOL)and degree of total leverage (DTL)using 20,000 units as a base sales level.

(a3)the operating breakeven point in units.

(b)Which operating structure has greater operating leverage and business risk?

(c)If China America projects sales of 20,000 units,which operating structure is recommended?

Correct Answer:

Verified

(a1)  (a2)and (a3)

(a2)and (a3)  (b)Operating structu...

(b)Operating structu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: The operating breakeven point can be found

Q5: The asymmetric information explanation of capital structure

Q9: The steeper the slope of the EBIT-EPS

Q12: Breakeven analysis is used by a firm

Q68: Financial risk is the risk to a

Q86: A firm has fixed operating costs of

Q155: A firm has a current capital structure

Q166: Harry Trading Company must choose its optimal

Q195: Tony's Beach T-Shirts has fixed annual operating

Q200: Financial leverage may be defined as the