Multiple Choice

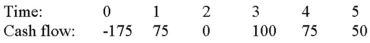

Compute the MIRR statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A) 13.26 percent, accept

B) 13.89 percent, accept

C) 13.26 percent, reject

D) 15.73 percent, accept

Correct Answer:

Verified

Correct Answer:

Verified

Q14: When choosing between two mutually exclusive projects

Q50: A disadvantage of the payback statistic is

Q60: Which of the following is a technique

Q62: We accept projects with a positive NPV

Q63: Which of the following is a technique

Q114: Compute the NPV for Project X and

Q115: Suppose your firm is considering investing in

Q117: Suppose your firm is considering two mutually

Q122: Contrast the use of the internal rate

Q123: Suppose your firm is considering investing in