Multiple Choice

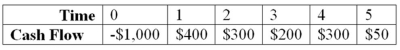

Compute the MIRR statistic for Project I and note whether to accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 15 percent.

Project I

A) The project's MIRR is 10.29 percent and the project should be rejected.

B) The project's MIRR is 12.67 percent and the project should be rejected.

C) The project's MIRR is 17.17 percent and the project should be accepted.

D) The project's MIRR is 18.19 percent and the project should be accepteD.Cash flows will be moved as shown:

Correct Answer:

Verified

Correct Answer:

Verified

Q32: All of the following capital budgeting tools

Q37: All capital budgeting techniques<br>A) render the same

Q82: Suppose your firm is considering two independent

Q83: Suppose two projects with normal cash flows,X

Q84: Suppose your firm is considering two independent

Q85: Suppose your firm is considering investing in

Q86: Suppose your firm is considering two mutually

Q88: Suppose your firm is considering two mutually

Q89: Compute the payback statistic for Project X

Q91: A company is considering two mutually exclusive