Multiple Choice

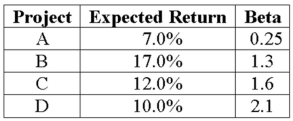

An all-equity firm is considering the projects shown as follows.The T-bill rate is 4 percent and the market risk premium is 9 percent.If the firm uses its current WACC of 14 percent to evaluate these projects,which project(s) will be incorrectly rejected?

A) Project A

B) Project B

C) Project C

D) Project D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is a situation

Q11: JAK Industries has 5 million shares of

Q25: FlavR Co. stock has a beta of

Q27: When firms use multiple sources of capital,

Q66: FarCry Industries, a maker of telecommunications equipment,

Q81: Which of the following makes this a

Q93: Suppose your firm has decided to use

Q96: A firm has 4,000,000 shares of common

Q106: Which of the following makes this a

Q119: XYZ Industries has 10 million shares of