Multiple Choice

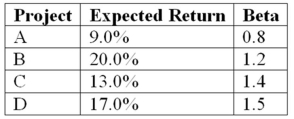

An all-equity firm is considering the projects shown as follows.The T-bill rate is 3 percent and the market risk premium is 6 percent.If the firm uses its current WACC of 12 percent to evaluate these projects,which project(s) ,if any,will be incorrectly rejected?

A) Only Project A would be incorrectly rejected.

B) Both Projects A and C would be incorrectly rejected.

C) Projects A, B, and C would be incorrectly rejected.

D) None of the projects would be incorrectly rejecteD.Step 1: Find Project Required Returns using CAPM.Project A: 7.8 percent; Project B: 10.2 percent; Project C: 11.4 percent; Project D: 12 percent; only Project A would be incorrectly rejected since its required return is only 7.8 percent given its risk and it is expected to return 9 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: What is the theoretical minimum for the

Q74: Apple's 9 percent annual coupon bond has

Q78: TJ Co. stock has a beta of

Q109: List and explain all the components of

Q109: Which of these statements is true regarding

Q110: Sports Corp.has 10 million shares of common

Q112: When calculating the weighted average cost of

Q117: Define subjective and objective approaches to divisional

Q118: Which of the following statements is correct?<br>A)The

Q122: JaiLai Cos. stock has a beta of