Multiple Choice

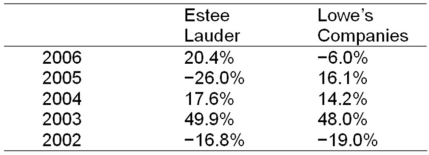

Consider the following annual returns of Estee Lauder and Lowe's Companies:

Compute each stock's average return,standard deviation,and coefficient of variation.

A) Estee Lauder: 9.02 percent; 17.99 percent; 2.00 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

B) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

C) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 25.46 percent; 2.39

D) Estee Lauder: 10.7 percent; 17.79 percent; 1.66 and Lowe's Companies: 12.64 percent; 18.99 percent; 1.50

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Portfolio Return The following table shows your

Q20: Average Return The past five monthly returns

Q21: Portfolio Return Year to date,Company Y had

Q22: Consider the following correlations:<br>Given this data,which of

Q25: Which of the following statements is correct?<br>A)The

Q26: Standard Deviation The standard deviation of the

Q28: Portfolio Return Year to date,Company Y had

Q29: What is the source of firm-specific risk?

Q62: The total risk of the S&P 500

Q75: Which of these includes any capital gain