Essay

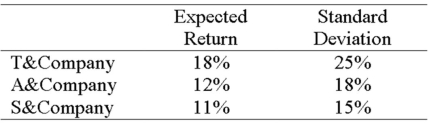

Diversifying Consider the characteristics of the following three stocks:

The correlation between T&Company and A&Company is -0.2.The correlation between T&Company and S&Company is -0.21.The correlation between A&Company and S&Company is 0.95.If you can pick only two stocks for your portfolio,which would you pick? Why?

Correct Answer:

Verified

A&Company and S&Company have similar exp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Which of the following is correct?<br>A)Over a

Q19: Which of these is a measure of

Q23: Year-to-date, Oracle had earned a 15.0 percent

Q25: Which of the following are investor diversification

Q30: Which of the following is incorrect?<br>A)It is

Q31: Which of these is the portion of

Q34: Investment Return Noble stock was $60.00 per

Q38: Total Risk Rank the following three stocks

Q41: Investment Return MedTech Corp.stock was $50.95 per

Q87: If you own 400 shares of Xerox