Multiple Choice

Use the table for the question(s) below.

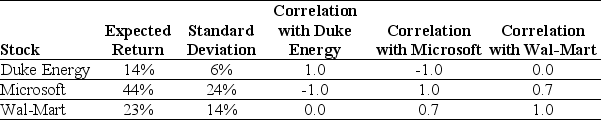

Consider the following expected returns, volatilities, and correlations:

-The volatility of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

A) 9%

B) 14%

C) 11%

D) 12%

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Which of the following statements is FALSE?<br>A)Because

Q34: Use the information for the question(s)below.<br>Tom's portfolio

Q58: Use the information for the question(s)below.<br>Suppose you

Q82: Use the table for the question(s)below.<br>Consider the

Q88: Suppose you invest $15,000 in Merck stock

Q93: Use the information for the question(s)below.<br>Suppose that

Q94: Use the following information to answer the

Q99: Which of the following statements is FALSE?<br>A)

Q119: Use the information for the question(s)below.<br>Suppose that

Q130: Use the information for the question(s)below.<br>Suppose you