Multiple Choice

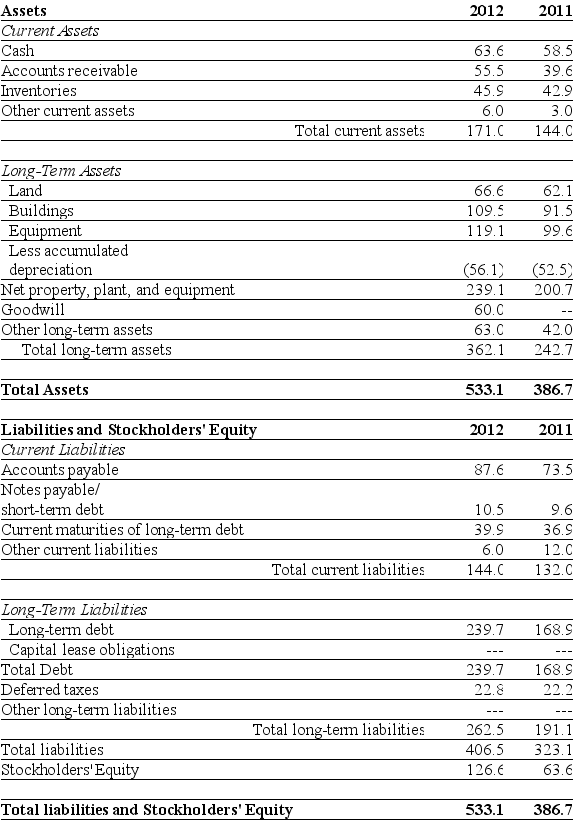

Use the table for the question(s) below.

Consider the following balance sheet:

-When using the book value of equity, the debt to equity ratio for Luther in 2012 is closest to:

A) 0.43

B) 2.29

C) 2.98

D) 3.57

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Use the information for the question(s)below.<br>In November

Q14: The firm's equity multiplier measures:<br>A)the value of

Q81: Use the table for the question(s)below.<br>Consider the

Q82: How often are public companies normally required

Q83: Use the table for the question(s)below.<br>Consider the

Q85: If Moon Corporation's gross margin declined,which of

Q86: Use the information for the question(s)below.<br>In November

Q88: On the balance sheet, short-term debt appears:<br>A)in

Q89: Use the table for the question(s)below.<br>Consider the

Q91: Use the tables for the question(s)below.<br>Consider the