Multiple Choice

Use the table for the question(s) below.

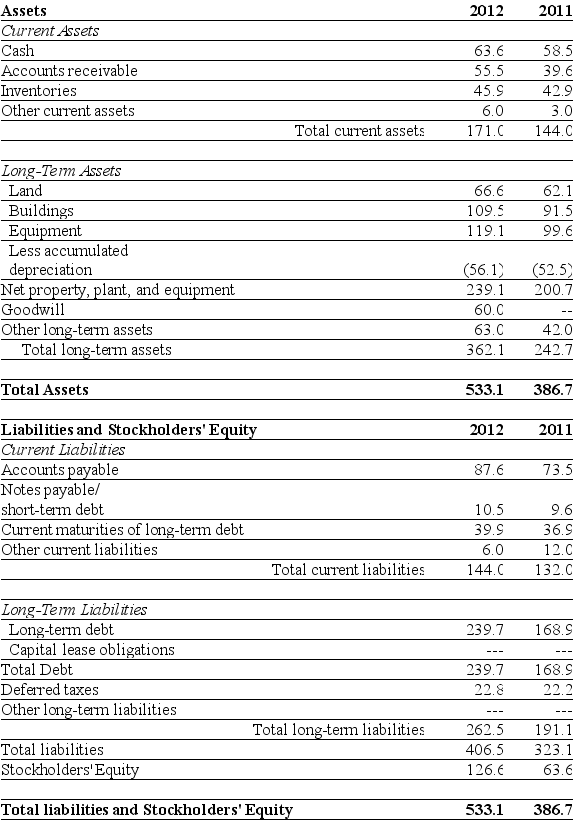

Consider the following balance sheet:

-If in 2012 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt to equity ratio for Luther in 2012 is closest to:

A) 1.47

B) 1.78

C) 2.31

D) 4.07

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Use the information for the question(s)below.<br>In November

Q58: Which of the following statements regarding net

Q62: The third party who checks annual financial

Q63: Use the table for the question(s)below.<br>Consider the

Q66: Use the table for the question(s)below.<br>Consider the

Q68: Use the table for the question(s)below.<br>Consider the

Q69: Use the table for the question(s)below.<br>Consider the

Q91: Use the information for the question(s)below.<br>In November

Q93: Use the information for the question(s)below.<br>In November

Q98: Which of the following is NOT an