Multiple Choice

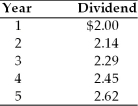

A firm has common stock with a market price of $55 per share and an expected dividend of $2.81 per share at the end of the coming year. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of the firm's common stock equity is

The cost of the firm's common stock equity is

A) 4.1 percent.

B) 5.1 percent.

C) 12.1 percent.

D) 15.4 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: As the volume of financing increases, the

Q27: Historical weights are either book value or

Q29: The specific cost of each source of

Q33: The cost of retained earnings equity for

Q34: The cost of capital can be thought

Q35: Table 9.1<br>A firm has determined its optimal

Q90: The cost of new common stock financing

Q103: Table 9.2<br>A firm has determined its optimal

Q114: A firm can retain more of its

Q127: Given that the cost of common stock