Multiple Choice

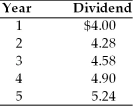

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive capital market. Flotation costs are expected to total $1 per share. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is

The cost of this new issue of common stock is

A) 5.8 percent.

B) 7.7 percent.

C) 10.8 percent.

D) 12.8 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: A firm has common stock with a

Q85: The net proceeds used in calculation of

Q89: The firm's optimal mix of debt and

Q90: Generally the least expensive source of long-term

Q91: The cost of capital is the rate

Q92: The cost of capital is a dynamic

Q94: Tangshan Mining is considering issuing long-term debt.

Q96: One measure of the cost of common

Q97: What would be the cost of new

Q101: The cost of retained earnings is generally