Multiple Choice

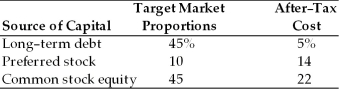

A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target market value proportions:  If the firm were to shift toward a more leveraged capital structure (i.e., a greater percentage of debt in the capital structure) , the weighted average cost of capital would

If the firm were to shift toward a more leveraged capital structure (i.e., a greater percentage of debt in the capital structure) , the weighted average cost of capital would

A) increase.

B) remain unchanged.

C) decrease.

D) not be able to be determined.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: The target capital structure is the desired

Q29: A firm has a beta of 1.2.

Q58: The cost to a corporation of each

Q59: One major expense associated with issuing new

Q62: The approximate before-tax cost of debt for

Q64: A corporation has concluded that its financial

Q65: Target weights are either book value or

Q66: The _ is a weighted average of

Q67: A company's historical target capital structure is

Q122: From a bond issuer's perspective, the IRR