Multiple Choice

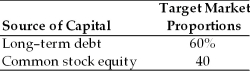

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share. The dividend expected to be paid at the end of the coming year is $5. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.10. It is expected that to sell, a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm has a marginal tax rate of 40 percent.

-The firm's cost of retained earnings is ________. (See Table 9.2)

A) 10.2 percent

B) 14.3 percent

C) 16.7 percent

D) 17.0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A firm has issued 10 percent preferred

Q11: Table 9.3<br>Balance Sheet<br>General Talc Mines<br>December 31, 2003

Q12: The cost of common stock equity capital

Q13: Firms underprice new issues of common stock

Q14: The four basic sources of long-term funds

Q17: In order to recognize the interrelationship between

Q18: In computing the weighted average cost of

Q19: Nico Trading Corporation is considering issuing long-term

Q20: The constant growth valuation model the Gordon

Q75: A tax adjustment must be made in