Multiple Choice

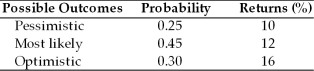

The expected value and the standard deviation of returns for asset A is (See below.) Asset A

A) 12 percent and 4 percent

B) 12.7 percent and 2.3 percent

C) 12.7 percent and 4 percent

D) 12 percent and 2.3 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Investors should recognize that betas are calculated

Q61: Changes in risk aversion, and therefore shifts

Q74: Diversifiable risk is the relevant portion of

Q78: Combining negatively correlated assets can reduce the

Q110: Unsystematic risk can be eliminated through diversification.

Q129: The real utility of the coefficient of

Q171: A(n) _ portfolio maximizes return for a

Q174: If a person's required return decreases for

Q175: On average, during the past 75 years,

Q177: Greater risk aversion results in lower required