Essay

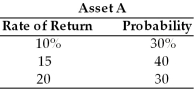

Assuming the following returns and corresponding probabilities for asset A, compute its standard deviation and coefficient of variation.

Correct Answer:

Verified

SD = 3.87...

SD = 3.87...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q51: Combining two assets having perfectly negatively correlated

Q137: On average, during the past 75 years,

Q138: As risk aversion increases<br>A) a firm's beta

Q139: The security market line (SML) reflects the

Q140: Business risk is the chance that the

Q142: Asset Y has a beta of 1.2.

Q143: Interest rate risk is the chance that

Q146: Even if assets are not negatively correlated,

Q147: A common approach of estimating the variability

Q179: Table 8.2<br>You are going to invest $20,000