Multiple Choice

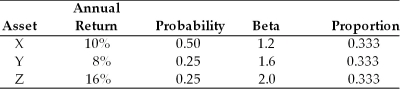

Table 8.2

You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows:

-What is the expected market return if the expected return on asset X is 20 percent, its beta is 1.5, and the risk free rate is 5 percent?

A) 5.0%

B) 7.5%

C) 15.0%

D) 22.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q64: The inclusion of assets from countries that

Q73: Combining two negatively correlated assets to reduce

Q74: In the capital asset pricing model, the

Q75: Given the following expected returns and standard

Q77: For the risk-seeking manager, no change in

Q79: The slope of the SML reflects the

Q80: Given the following information about the two

Q81: An efficient portfolio is one that<br>A) maximizes

Q101: Diversified investors should be concerned solely with

Q118: Dr. Dan is considering investment in a