Multiple Choice

Table 8.3

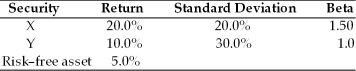

Consider the following two securities X and Y.

-________ in the beta coefficient normally causes ________ in the required return and therefore ________ in the price of the stock, all else remaining the same.

A) An increase; an increase; an increase

B) An increase; a decrease; an increase

C) An increase; an increase; a decrease

D) A decrease; a decrease; a decrease

Correct Answer:

Verified

Correct Answer:

Verified

Q52: When the U.S. currency gains in value,

Q69: Asset A was purchased six months ago

Q79: The slope of the SML reflects the

Q80: Given the following information about the two

Q81: An efficient portfolio is one that<br>A) maximizes

Q85: Examples of events that increase risk aversion

Q86: War, inflation, and the condition of the

Q86: Beta coefficient is an index of the

Q88: Since for a given increase in risk,

Q89: What is the expected return for asset