Essay

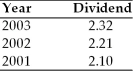

China America Manufacturing has a beta of 1.50, the risk-free rate of interest is currently 12 percent, and the required return on the market portfolio is 18 percent. The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate consistent with that experienced over the 2001-2003 period.  Estimate the value of China America Manufacturing's stock.

Estimate the value of China America Manufacturing's stock.

Correct Answer:

Verified

ks = 0.12 + 1.50(0.18 - 0.12)

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Because equity holders are the last to

Q75: The Erie Heating Company has been very

Q76: The preemptive right gives the shareholder the

Q77: Firms occasionally repurchase stock in order to

Q78: Interest paid to bondholders is tax deductible

Q81: In common stock valuation, any action taken

Q82: Any action taken by the financial manager

Q85: Julie's X-Ray Company paid $2.00 per share

Q104: To a buyer, an asset's value represents

Q174: The amount of the claim of preferred