Multiple Choice

Table 4.4

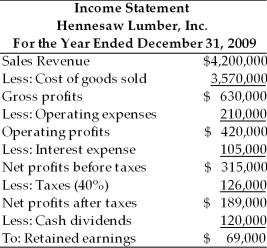

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2010, for Hennesaw Lumber, Inc.

Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2010. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2009 is shown below. From your preparation of the pro forma income statement, answer the following multiple choice questions.

-The pro forma cost of goods sold for 2010 is ________. (See Table 4.4)

A) $3,500,000

B) $3,750,000

C) $3,825,000

D) $4,000,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The excess cash balance is the amount

Q15: For firms with high fixed costs, the

Q16: Since depreciation and other non-cash charges represent

Q21: The financial planning process begins with short-run,

Q22: A firm plans to retire outstanding bonds

Q23: Table 4.4<br>Use the percent-of-sales method to prepare

Q46: A firm's operating cash flow (OCF) is

Q86: Table 4.8 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 4.8

Q133: The _ method of developing a pro

Q176: The MACRS depreciation method requires use of