Multiple Choice

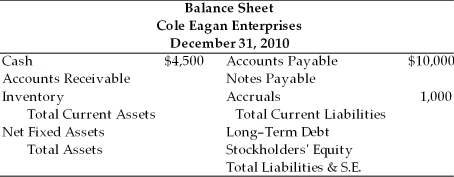

Table 3.1  Information (2010 values)

Information (2010 values)

1. Sales totaled $110,000

2. The gross profit margin was 25 percent.

3. Inventory turnover was 3.0.

4. There are 360 days in the year.

5. The average collection period was 65 days.

6. The current ratio was 2.40.

7. The total asset turnover was 1.13.

8. The debt ratio was 53.8 percent.

-Long-term debt for CEE in 2010 was ________. (See Table 3.1)

A) $30,763

B) $52,372

C) $10,608

D) $41,372

Correct Answer:

Verified

Correct Answer:

Verified

Q2: When preparing a statement of cash flows,

Q3: Net profits after taxes are defined as<br>A)

Q4: If Nico Corporation has annual purchases of

Q5: Net fixed assets represent the difference between

Q6: All of the following are examples of

Q8: Benchmarking is a type of cross-sectional analysis

Q9: The stockholder's report may include all of

Q10: The _ provides a financial summary of

Q11: Inflationary effects typically have a greater impact

Q12: Both present and prospective shareholders are interested