Multiple Choice

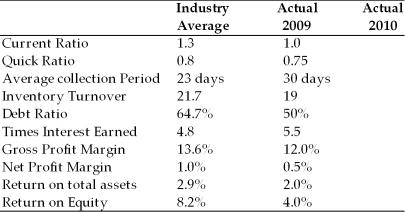

Table 3.2

Dana Dairy Products Key Ratios  Income Statement

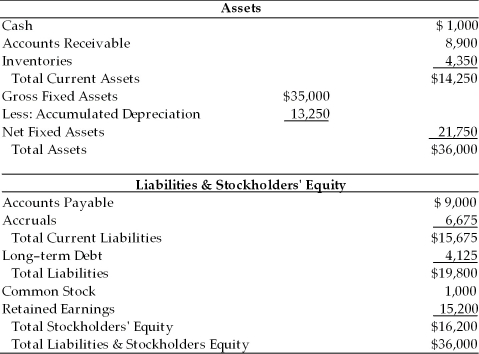

Income Statement

Dana Dairy Products

For the Year Ended December 31, 2010  Balance Sheet

Balance Sheet

Dana Dairy Products

December 31, 2010

-Using the modified DuPont formula allows the analyst to break Dana Dairy Products return on equity into 3 components: the net profit margin, the total asset turnover, and a measure of leverage (the financial leverage multiplier) . Which of the following mathematical expressions represents the modified DuPont formula relative to Dana Dairy Products' 2010 performance? (See Table 3.2)

A) 5.6(ROE) = 2.5(ROA) × 2.24(Financial leverage multiplier)

B) 5.6(ROE) = 3.3(ROA) × 1.70(Financial leverage multiplier)

C) 4.0(ROE) = 2.0(ROA) × 2.00(Financial leverage multiplier)

D) 2.5(ROE) = 5.6(ROA) × 0.44(Financial leverage multiplier)

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Net profit margin measures the percentage of

Q118: Firm ABC had operating profits of $100,000,

Q143: The primary concern of creditors when assessing

Q144: _ is where the firm's ratio values

Q145: Gross profit margin measures the percentage of

Q147: A firm had year end 2004 and

Q148: The firm's creditors are primarily interested in

Q149: Paid-in capital in excess of par represents

Q150: Without adjustment, inflation may tend to cause

Q151: The _ measures the overall effectiveness of