Essay

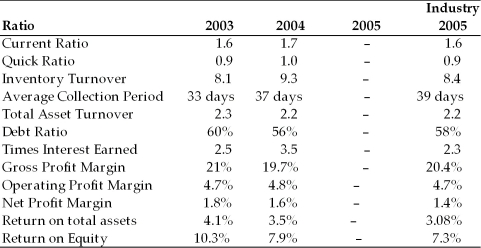

Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability.

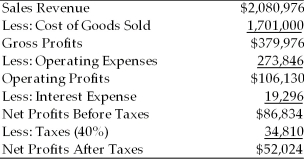

Income Statement

Pulp, Paper and Paperboard, Inc.

For the Year Ended December 31, 2005  Balance Sheet

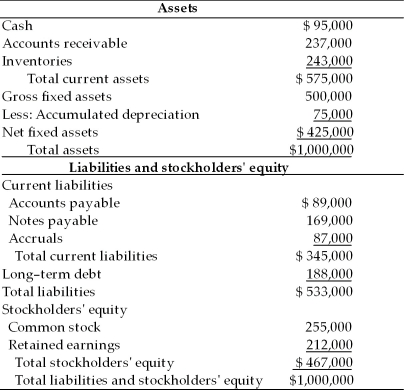

Balance Sheet

Pulp, Paper and Paperboard, Inc.

December 31, 2005  Historical and Industry Average Ratios

Historical and Industry Average Ratios

Pulp, Paper and Paperboard, Inc.

Correct Answer:

Verified

Historical and Industry Average Ratios

P...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

P...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Ag Silver Mining, Inc. has $500,000 of

Q96: FASB Standard No. 52 mandates that U.S.

Q97: Earnings per share represent the dollar amount

Q99: The _ measures the percentage of each

Q101: Complete the balance sheet for General Aviation,

Q103: _ analysis involves comparison of current to

Q104: A firm had year end 2004 and

Q105: Cross-sectional ratio analysis involves comparing the firm's

Q182: The Public Company Accounting Oversight Board (PCAOB)

Q203: Publicly owned corporations are those which are