Multiple Choice

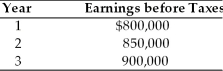

Maxi, Inc. is evaluating the acquisition of Mini, Inc., which had a loss carryforward of $2.75 million which resulted from earlier operations. Maxi can purchase Mini for $3.5 million and liquidate the assets for $1.25 million. Maxi expects earnings before taxes in the three years following the acquisition to be as follows:  (These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is

(These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is

A) $440,000.

B) $842,000.

C) $1.1 million.

D) $2.75 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A merger occurs when two or more

Q84: A leveraged buyout needs to be carried

Q85: If the P/E paid is equal to

Q86: In defending against a hostile takeover, the

Q87: The primary causes of business failure are

Q89: The basic difficulty in applying the capital

Q90: Typically in a leveraged buyout approximately _

Q91: The ratio of exchange in market price

Q93: The combination of two or more companies

Q130: A _ occurs when the operations of