Multiple Choice

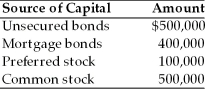

Aiyah, Inc. recently has had financial difficulty and is being liquidated by the Federal Bankruptcy Court. The firm has a liquidation value of $1,000,000 $400,000 from the fixed assets that served as collateral for the mortgage bonds and $600,000 from all other assets (all prior claims have been satisfied) . The firm's current capital structure is as follows:  The common stockholders will receive ________ in the liquidation.

The common stockholders will receive ________ in the liquidation.

A) $500,000

B) $333,333

C) $198,000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A major disadvantage of holding companies is

Q24: A major impetus fueling financial mergers during

Q72: A spin-off is a form of divestiture

Q80: A method of acquisition in which the

Q110: It is not unusual for acquirers in

Q112: The earnings per share of the merged

Q113: An attractive candidate for acquisition through a

Q119: When a firm undertakes a merger to

Q121: A financial merger is a merger transaction

Q183: A congeneric merger is a merger combining