Essay

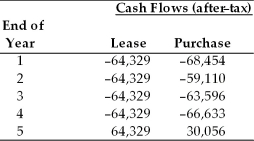

Bessey Aviation is considering leasing or purchasing a small aircraft to transport executives between manufacturing facilities and the main administrative headquarters. The firm is in the 40 percent tax bracket and its after-tax cost of debt is 7 percent. The estimated after-tax cash flows for the lease and purchase alternatives are given below:  (a) Given the above cash outflows for each alternative, calculate the present value of the after-tax cash flows using the after-tax cost of debt for each alternative.

(a) Given the above cash outflows for each alternative, calculate the present value of the after-tax cash flows using the after-tax cost of debt for each alternative.

(b) Which alternative do you recommend? Why?

Correct Answer:

Verified

(a)  (b) T...

(b) T...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: The warrant premium depends largely on investor

Q29: Contrary to convertibles, warrants provide for the

Q30: A convertible bond is almost always _

Q31: A _ permits the firm's capital structure

Q34: In general, the market value of a

Q36: Diluted earnings per share (EPS) are found

Q37: In case of an overhanging issue, if

Q38: The type of lease in which the

Q127: A conversion feature is an option that

Q168: Find the solution to the following questions