Multiple Choice

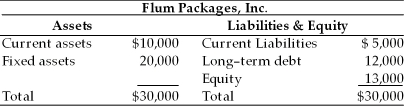

Table 15.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $3,000 of current assets to fixed assets, the firm's net working capital would ________, the annual profits on total assets would ________, and the risk of technical insolvency would ________, respectively. (See Table 15.2)

A) increase; decrease; increase

B) decrease; increase; decrease

C) increase; decrease; decrease

D) decrease; increase; increase

Correct Answer:

Verified

Correct Answer:

Verified

Q223: The first step in the collection of

Q268: In the ABC system of inventory management,

Q270: Disbursement float has all of the following

Q271: When a firm's cash conversion cycle is

Q272: Nellie's Finery<br>Credit Scoring Policy <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2927/.jpg" alt="Nellie's

Q274: If the cash discount period is increased,

Q275: The cash conversion cycle is the amount

Q277: All of the following securities are government

Q278: The goal of short-term financial management is

Q307: The increase in bad debts associated with