Multiple Choice

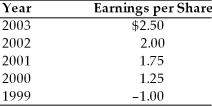

A firm has had the following earnings history over the last five years:  If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the years with earnings over $1.50 per share and a zero payout otherwise, the annual dividends for 1999 and 2003 were

If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the years with earnings over $1.50 per share and a zero payout otherwise, the annual dividends for 1999 and 2003 were

A) $0.50 and $1.25, respectively.

B) $0 and $2.00, respectively.

C) $0 and $1.25, respectively.

D) $0 and $0.88, respectively.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Because dividends are taxed at the same

Q12: Stockholders dislike dividends that<br>A) are fixed.<br>B) fluctuate

Q14: A stock split commonly increases the number

Q15: The repurchase of stock _ the earnings

Q17: The regular dividend policy provides the owners

Q18: A firm has the following stockholders' equity

Q19: At a firm's quarterly dividend meeting held

Q20: An excess earnings accumulation tax is levied

Q21: The bird-in-the-hand argument espousing the importance of

Q42: By purchasing shares through a firm's dividend