Multiple Choice

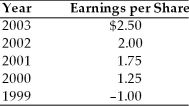

A firm has had the following earnings history over the last five years:  If the firm's dividend policy was to pay $0.25 per share each period except when earnings exceed $1.50, when an extra dividend equal to 50 percent of the earnings above $1.50 would be paid, the annual dividends for 2000 and 2003 were

If the firm's dividend policy was to pay $0.25 per share each period except when earnings exceed $1.50, when an extra dividend equal to 50 percent of the earnings above $1.50 would be paid, the annual dividends for 2000 and 2003 were

A) $0.25 and $1.25, respectively.

B) $0.25 and $0.75, respectively.

C) $0 and $0.25, respectively.

D) $0.25 and $0.25, respectively.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: The residual theory of dividends implies that

Q33: The problem with a constant-payout-ratio dividend policy

Q34: The factors involved in setting a dividend

Q36: The level of dividends a firm expects

Q37: In general, with regard to dividend payments,

Q38: The bird-in-the-hand argument espousing the importance of

Q39: A firm that has a large percentage

Q40: The representative theory of dividends, as espoused

Q53: If a firm has overdue liabilities or

Q59: By purchasing shares through a firm's dividend