Essay

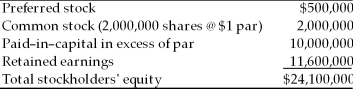

Hayley's Optical has a stockholders' equity account as shown below. The firm's common stock currently sells for $20 per share.  (a) What is the maximum dividend per share Hayley's Optical can pay? (Assume capital includes all paid-in capital.)

(a) What is the maximum dividend per share Hayley's Optical can pay? (Assume capital includes all paid-in capital.)

(b) Recast the partial balance sheet (the stockholders' equity accounts) to show independently

(1) a 2 for 1 stock split of the common stock.

(2) a cash dividend of $1.50 per share.

(3) a stock dividend of 5% on the common stock.

(c) At what price would you expect Hayley's Optical stock to sell after

(1) the stock split?

(2) the stock dividend?

Correct Answer:

Verified

(a) The maximum dividend per share the f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: The repurchase of common stock results in

Q54: Tangshan Mining Company has released the following

Q55: The advantage of using the low-regular-and-extra dividend

Q56: The information content of dividends refers to<br>A)

Q57: The clientele effect refers to<br>A) the relevance

Q60: Stock repurchases are made for all of

Q61: Gordon's "bird-in-the-hand" argument suggests that<br>A) dividends are

Q62: A _ has an effect on the

Q63: Dividends provide information about the firm's current

Q64: The payment date is five days after