Multiple Choice

Table 12.2

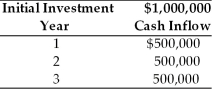

A firm is considering investment in a capital project which is described below. The firm's cost of capital is 18 percent and the risk-free rate is 6 percent. The project has a risk index of 1.5. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-It has been found that the value of the stock of corporations whose shares are traded publicly in an efficient marketplace is

A) generally positively affected by diversification, because of the reduction in risk.

B) generally negatively affected by diversification, because of the increase in risk.

C) generally not affected by diversification, unless greater returns are expected.

D) generally negatively affected by diversification, because of the increase in the required rate of return.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The risk-adjusted discount rate approach to evaluating

Q89: Table 12.1<br>A corporation is assessing the risk

Q90: In selecting the best group of unequal-lived

Q91: Major types of real options include all

Q92: In general, political risk is easier to

Q93: Breakeven cash inflow refers to<br>A) the minimum

Q95: The ordering of capital expenditure projects on

Q97: In the context of capital budgeting, risk

Q98: The IRR approach to capital rationing involves

Q99: Scenario analysis is an approach that uses