Multiple Choice

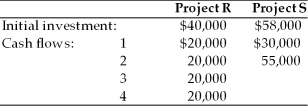

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows:

A) Chose Project R because its ANPV is $6460

B) Chose Project S because its ANPV is $6460

C) Chose Project R because its ANPV is $18,274

D) Chose Project S because its ANPV is $10637

Correct Answer:

Verified

Correct Answer:

Verified

Q13: In case of international capital budgeting, long-term

Q14: When unequal-lived projects are independent, the length

Q15: Projects with a small chance of being

Q18: The danger that an unexpected change in

Q19: A behavioral approach that evaluates the impact

Q21: Even though a business firms can be

Q22: In the real world, different projects have

Q26: The risk-adjusted discount rate (RADR) is the

Q56: The risk-adjusted discount rate can be computed

Q93: The objective of capital rationing is to