Multiple Choice

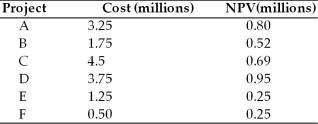

As a top manager, you must decide firm which of the proposed projects should be accepted for the upcoming year since only $6 million is available for the next year's capital budget. What is the total NPV of the projects that should be accepted?

A) A, B, & F; total cost = $5.5 million; Total NPV= $1.57

B) F, B, & D; total cost = $6 million; Total NPV= $1.72

C) E, F, & D; total cost = $65.5 milliom; Total NPV= $1.45

D) Can not be determined.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Exchange rate risk is the the risk

Q65: Despite their focus on total risk, RADRs

Q68: The annualized net present value approach to

Q69: The advantage of using simulation in the

Q70: In general, exchange rate risk is easier

Q71: Behavioral approaches for dealing with risk include

Q71: In capital budgeting, risk refers to the

Q85: The output of simulation provides an excellent

Q89: The _ approach is used to convert

Q91: Table 12.4<br>Johnson Farm Implement is faced with