Multiple Choice

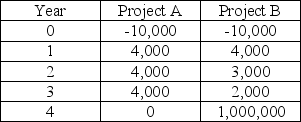

Evaluate the following projects using the payback method assuming a rule of 3 years for payback.

A) Project A can be accepted because the payback period is 2.5 years but Project B can not be accepted because it's payback period is longer than 3 years.

B) Project B should be accepted because even thought the payback period is 2.5 years for project A and 3.001 project B, there is a $1,000,000 payoff in the 4th year in Project B.

C) Project B should be accepted because you get more money paid back in the long run.

D) Both projects can be accepted because the payback is less than 3 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The internal rate of return assumes that

Q41: Certain mathematical properties may cause a project

Q77: The IRR method assumes the cash flows

Q123: Projects having higher cash inflows in the

Q130: A firm with limited dollars available for

Q131: In capital budgeting, the preferred approaches in

Q133: On a purely theoretical basis, NPV is

Q136: There is sometimes a ranking problem among

Q137: In spite of the theoretical superiority of

Q138: If its IRR is greater than the