Multiple Choice

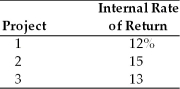

A firm with a cost of capital of 13 percent is evaluating three capital projects. The internal rates of return are as follows:  The firm should

The firm should

A) accept Project 2 and reject Projects 1 and 3.

B) accept Projects 2 and 3 and reject Project 1.

C) accept Project 1 and reject Projects 2 and 3.

D) accept Project 3 and reject Projects 1 and 2.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: The IRR method assumes the cash flows

Q138: If its IRR is greater than the

Q140: Examples of sophisticated capital budgeting techniques include

Q141: Should Tangshan Mining company accept a new

Q142: The final step in the capital budgeting

Q144: Payback is considered an unsophisticated capital budgeting

Q145: If its IRR is greater than 0

Q146: The evaluation of capital expenditure proposals to

Q147: A sophisticated capital budgeting technique that can

Q148: The payback period of a project that