Multiple Choice

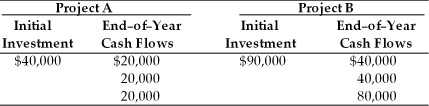

Table 10.3

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows:

-The new financial analyst does not like the payback approach (Table 10.3) and determines that the firm's required rate of return is 15 percent. His recommendation would be to

A) accept projects A and B.

B) accept project A and reject B.

C) reject project A and accept B.

D) reject both.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Table 10.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2927/.jpg" alt="Table 10.2

Q3: The basic motives for capital expenditures are

Q8: Consider the following projects, X and Y

Q9: A $60,000 outlay for a new machine

Q10: What is the NPV for the following

Q11: Projects that compete with one another, so

Q47: A project must be rejected if its

Q57: In comparing the internal rate of return

Q81: The payback period of a project that

Q127: If a project's payback period is greater