Essay

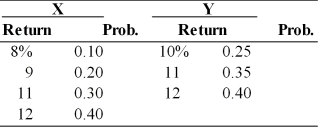

Given the following probability distribution for assets X and Y, compute the expected rate of return, variance, standard deviation, and coefficient of variation for the two assets. Which asset is a better investment?

Correct Answer:

Verified

Expected value = 10.7% Expect...

Expected value = 10.7% Expect...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: A given change in inflationary expectations will

Q20: Coefficient of variation is a measure of

Q43: Nico bought 100 shares of Cisco Systems

Q62: The _ is a measure of relative

Q65: A beta coefficient of -1 represents an

Q68: Table 8.2<br>You are going to invest $20,000

Q74: Diversifiable risk is the relevant portion of

Q133: Assume your firm produces a good which

Q139: The security market line (SML) reflects the

Q177: Greater risk aversion results in lower required